If you’re in need of a personal loan, you may be wondering how to find the best option for you. There are a few things you’ll want to keep in mind when searching for a personal loan, and by following these tips you can be sure you’ll find the right loan for your needs.

Simple Tips for Finding the Right Personal Loan Online

First, consider the interest rate. You’ll want to find a loan with an interest rate that is as low as possible, so be sure to compare rates from a few different lenders. Next, think about the repayment terms. You’ll want to find a loan that has terms that you’re comfortable with, and that you can afford to repay.

Finally, make sure you understand all the fees and charges associated with the loan. Be sure to ask about any hidden fees or charges so you’re not surprised by them later. By keeping these things in mind, you can be sure to find the best personal loan for your needs. Get started now by visiting Personal Loan Pro!

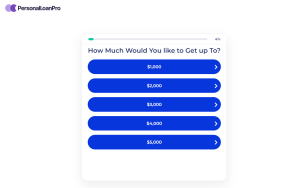

How Much Personal Loan Can We Apply for?

When it comes to personal loans, there is no one-size-fits-all answer to the question of how much you can borrow. The amount that you can apply for will depend on a number of factors, including your income, employment status, credit history, and other financial obligations.

That being said, there are some general guidelines that can give you an idea of how much you may be able to borrow. Generally speaking, most lenders will allow you to borrow up to $50,000 for a personal loan. However, if you have good credit and a steady income, you may be able to borrow more.

If you’re not sure how much you can borrow, the best thing to do is to speak to a loan specialist who can help you determine your borrowing capacity. They will take into account all of the factors mentioned above, and they will be able to give you a more accurate estimate of how much you can borrow; For instance, it is a good way to check personal loans at Personal Loan Pro.

How to Get Approved for Personal Loans?

If you’re considering taking out a personal loan from direct lenders or loan brokers like Personal Loan Pro, you may be wondering how to get approved. Here are a few tips to give you the best chance of success.

First, check your credit score. Lenders or brokers will use this to determine your eligibility for a loan, so it’s important to know where you stand. If your score is on the low side, you may still be able to get a loan but you may have to pay a higher interest rate.

Next, gather up all your financial documentation. This will include things like bank statements, pay stubs, and tax returns. Having this information handy will make the loan application process go more smoothly.

Finally, research different lenders. Not all lenders have the same requirements or offer the same terms. Shopping around will help you find the best deal on a personal loan.

Following these steps should give you a good chance of getting approved for a personal loan. Just be sure to manage your finances responsibly after taking out the loan to avoid any future difficulties.

Where to Get Personal Loans From?

If you’re looking for personal loans, there are a few different places you can turn. Here’s a quick rundown of some of the most popular options:

- Banks: Banks are a good place to start your search for a personal loan. Many banks offer personal loans with competitive interest rates and terms.

- Credit Unions: Credit unions are another good option for personal loans. Like banks, credit unions often offer personal loans with competitive rates and terms.

- Online Lenders: There are a number of online lenders that offer personal loans. Many of these lenders have competitive rates and terms.

- Peer-to-Peer Lenders: Peer-to-peer lenders are a newer option for personal loans. These lenders connect borrowers with investors who are willing to fund loans. Rates and terms vary, but peer-to-peer lenders typically offer competitive rates.

Now that you know where to get personal loans, the next step is to compare rates and terms to find the right loan for you.

Naa Songs

Naa Songs